The answer to this question is not as straightforward as you might think. It’s true that brokers are businesses, and they need to generate revenue in order to stay afloat. But there are many different ways for brokers to do so. Some of these methods include charging commissions on trades, offering trading software with premium features, or providing research content that is exclusive for clients who pay an extra fee. For the most part, however, brokers earn their money through spreads – which is the difference between what buyers offer and sellers ask for when they trade pairs of currencies (or other assets).

Do Forex brokers lose money?

Forex brokers are a business, and like all businesses they have to make money. One of the most common questions is “Do Forex brokers lose money?” This blog post will answer that question and provide some insight into how Forex brokers operate.

Forex Brokers do not charge commissions on trades, meaning that their profits come from spreads between buy and sell prices. These spreads can be as little as 1 pip or up to 20 pips depending on the market conditions at any given time. A pip is a small unit representing one cent of price movement in any given currency pair trade (e.g., EUR/USD).

Do I need a broker for forex?

The question of whether or not you need a broker for forex is one that many people are asking themselves. The answer, in short, is no – all you need to do is open an account with any major bank and invest your money there through the forex market. However, what most people don’t know is that brokers provide their clients with additional services like financial advice and customer service. For some investors, these benefits can outweigh the cost of commissions on transactions. So if you’re looking for more than just investing your money in the forex market but also want to be able to get help when needed, then it might make sense for you to hire a broker instead of managing your investments yourself.

Which broker is the best for forex?

You might be wondering which broker is the best for forex trading. This article will explore three brokers and what they offer so you can make a decision on your own.

The first broker is FXCM, a well-known company that has been around for over 20 years and offers many different features, including trade alerts based on news events, low spreads, and fast execution times. The next broker is Oanda with competitive pricing across all of their platforms as well as live chat support from 9 am to 5 pm EST everyday. Finally there’s TradeStation which specializes in equities but also provides forex services from its global offices around the world.

click here – 5 Simple Facts About Owning A Pet Cat

Can I trade forex on my own?

The Foreign Exchange market is a place where currencies from all over the world are traded. The Forex market, also known as FX-market, trades currencies on a daily basis and can be accessed through online platforms such as MT4 or MetaTrader 4. Trading in forex is not for everyone and it requires both dedication and time to learn the ropes of this complex marketplace. If you’re looking to trade Forex on your own, we will cover some important points so that you feel confident in taking the plunge.

We all know that the currency exchange market is a multi-trillion dollar industry. It’s a pretty big deal in other words. So, it makes sense to want to be involved in it right? But here’s the thing: there are so many brokers out there and they all have different rates of return, trading fees, etc. How do you pick one without getting scammed?

This blog post will answer this question by talking about how easy it is to get started with forex trading without having to go through the hassles of signing up with an online broker or even downloading any software! Read on for more information on how you can start making money today.

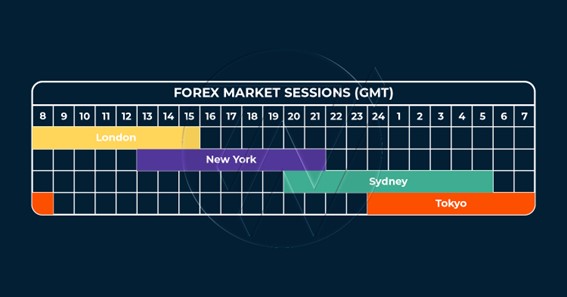

Images created and referenced from Trade Nation – What time does the forex market open. All distribution rights belong to the publisher and cannot be used without written permission.

How much do Forex brokers charge?

Forex brokers are a great way to start trading currencies, but how much do they charge? This blog post will cover the cost and benefits of forex brokers.

Cost: Forex brokers typically charge between $5-$25 per trade depending on your account size. The more money you have in your account, the cheaper it is to trade. Benefits: Brokers offer different types of accounts such as margin accounts which allow you to borrow money from them for each trade and credit spreads that allow you to take advantage of price discrepancies across international exchanges without having to open up multiple positions at once. They also offer customer service 24/7 for any questions or concerns about trading and can provide invaluable advice on what strategies work best with certain markets.

Read Also: A Beginner guide to understanding google ranking factors 2021

Forex Broker Etoro Reviews

Etoro is a forex broker that has been around since 2006. They offer traders the ability to trade on over 100 currency pairs and commodities, while still managing risk with stop losses and take profit orders. They also have an advanced copy trading platform so you can follow up-and-coming traders and learn from their successes and failures. Finally, they offer low spreads on all trades for maximum profitability. The Etoro Forex Broker Review 2021 will help you decide if this is the right broker for your needs.

Etoro review is a Forex broker that has been in the industry for over 10 years. It was founded by two Israeli brothers, Ophir and Ronen Assia, who are also the company’s CEO and COO respectively. The Etoro platform offers investors an easy way to trade on their own or copy other traders’ trades with just one click of a button. Investors can choose from four different types of accounts: Standard, Silver, Gold and Platinum account levels.